Disclosure: Meeple Mountain received a free copy of this product in exchange for an honest, unbiased review. This review is not intended to be an endorsement.

Training Montage

I struggle to get excited when someone says “train game.” The moment “18XX” hits the table, my brain checks out. I’ve enjoyed a few—Chicago Express, Age of Rail: South Africa, Iberian Gauge, and currently Ticket to Ride: Legends of the West (okay, not really 18XX but still a train game!)—but my bias remains: they all feel the same. Learn one, learn them all, right?

And while that may be true, it takes more than a new map to get me on board. I’m not great at market speculation or company valuation, which already puts me behind. But dress the system up with a new flavor, and I can be coaxed to the table. Dinosaurs in Cretaceous Rails? Bag-building in Lightning Train? A fresh spin goes a long way for non-train gamers like me.

Space Rails

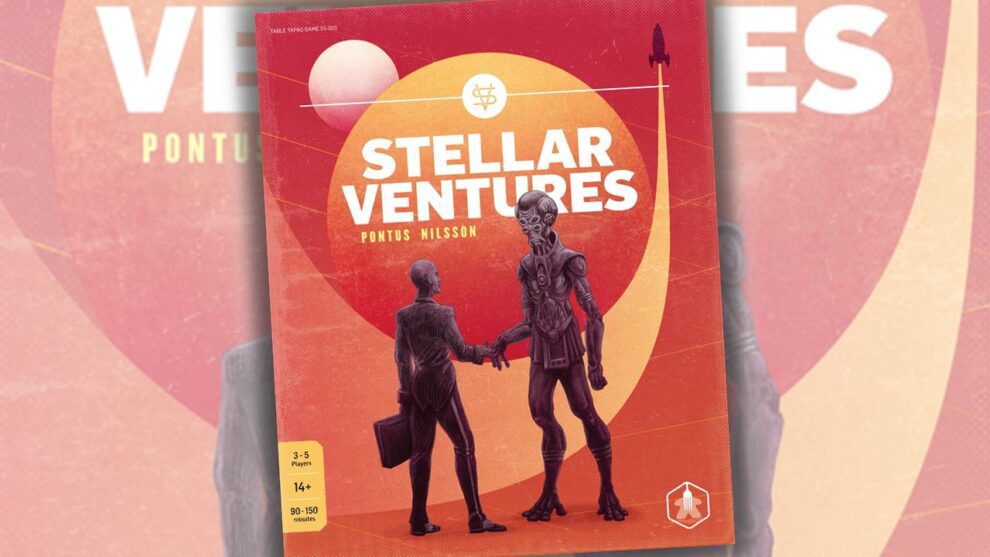

Enter Stellar Ventures, a spacefaring economic game from newcomer designer Pontus Nilsson. At a glance, you might think you’ve sat down at Gaia Project, but look closer: this is an investment-and-network puzzle that tests your galactic bookkeeping.

Crack open the Corporate Handbook and you’re greeted with midcentury-style product ads hyping expansion, investment, and tech development. Then comes the twist—aliens. And they’re eager to partner with you…with terms and conditions.

The cover alone hooked me like a pulpy ’70s/’80s sci-fi novel. But cube-rails economics with alien deals? That might actually convert me.

Starting Bid

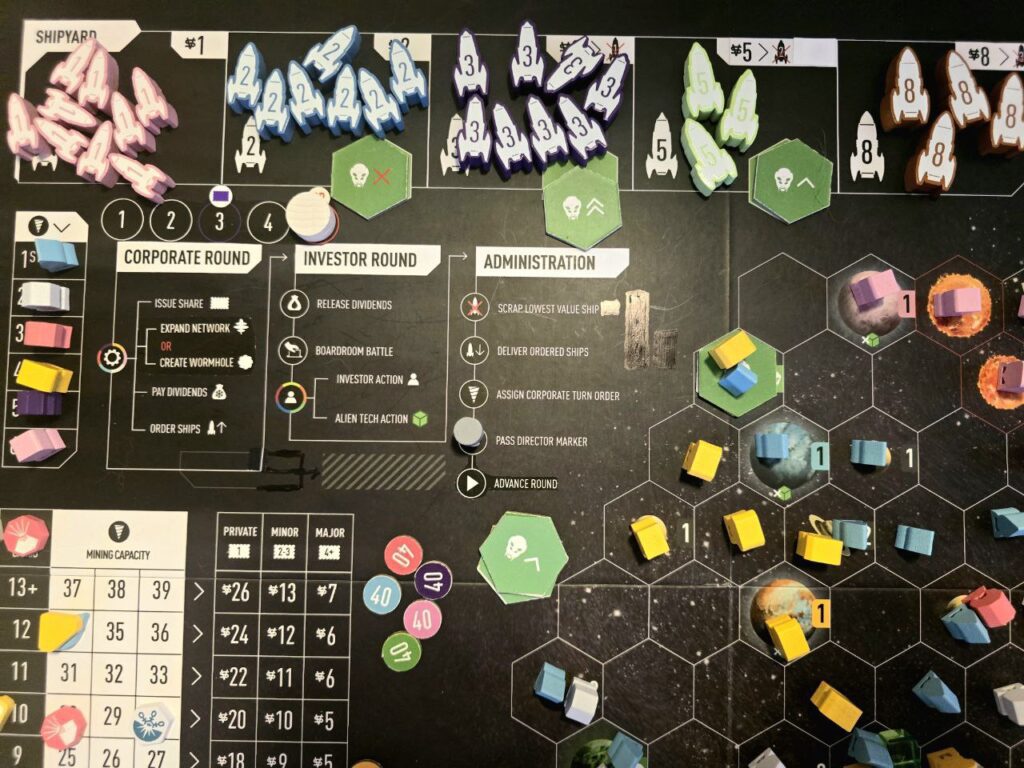

Stellar Ventures plays over five rounds (well, four and a half—more on that later) for 3–5 players, where most money wins. Players are investors propping up five corporations, with a sixth arriving mid-game.

Initial shares are auctioned in reverse corporate order. It seems procedural—until you realize early shareholders get first dibs on powerful tech. That’s when the drama kicks in.

Each corporation starts on a different planet with an asymmetric setup: different outpost counts, different nearby terrain, different early opportunities. Those starting conditions shape each corporation’s risk/reward as an investment.

Rounds follow a clean loop: corporate actions, investor actions, then administration. In the final round, the game skips straight from corporate actions to endgame scoring.

Corporate Shill

The majority shareholder becomes President and runs the corporation. You may issue a share to raise cash, then expand: spend corporation money to place up to five outposts. Simple—until one inefficient route comes back to bite you.

Open space is fair game, but anomalies block certain paths. Wormholes—once unlocked—let you skip across space. Neutral planets boost a corporation’s mining value, while building where another corporation already has an outpost costs extra.

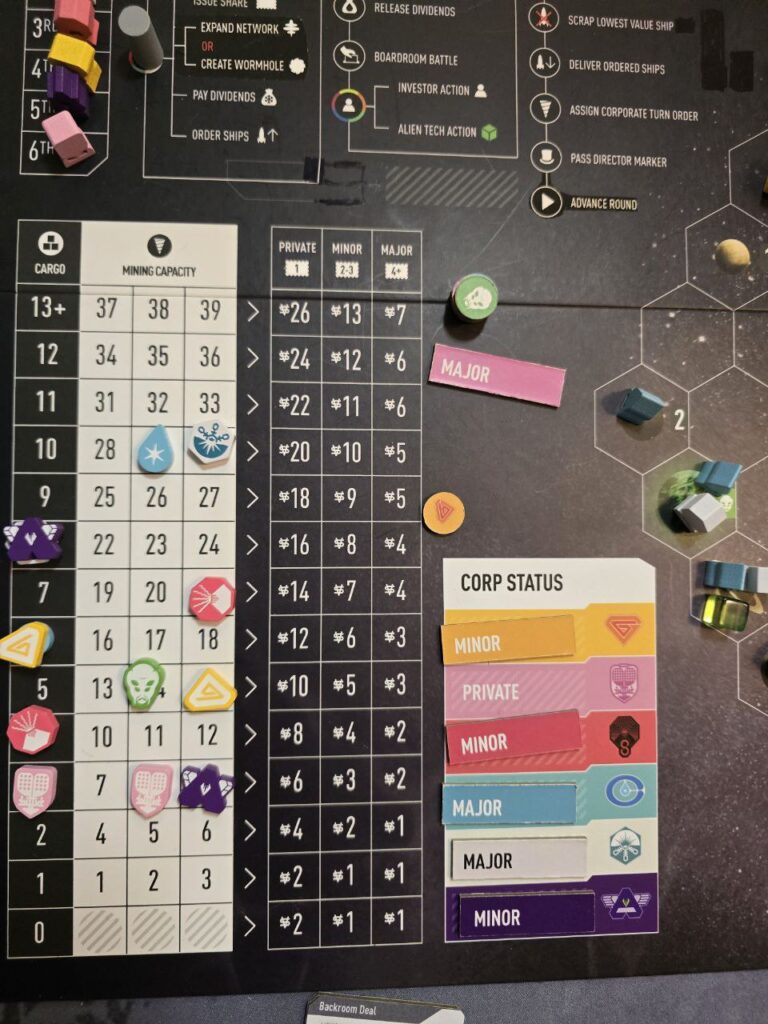

Next comes dividends. They’re based on the lower of the corporation’s cargo and mining capacity, adjusted by corporation size. As corporations issue more shares, they grow from private to minor to major, and dividends dilute (Investing 101!).

In a delightful change, dividends are paid by the bank, not from the corporation’s treasury. It flips the usual tension. You can spend aggressively without strangling your own returns. The tradeoff is that corporations feel a little less financially constrained than in harsher stock games—great for pace, slightly softer on consequences.

Finally, corporations buy ships, which increases cargo capacity during administration. Ship levels range from 1 to 8. When higher-level ships enter play, lower levels “rust” and get scrapped. Keeping up matters.

Corporations must own a ship. If you can’t afford one, you take an unrepayable loan that drags down the final share value. We had a corporation worth negative dollars per share. Consider yourself warned!

Investor Shenanigans

Now, players put on their investor hats. Dividends become liquid cash, ready for mischief.

First comes voting: players can spend limited vote tokens (six per game) to force a share sale. It’s a perfect moment to dilute dividends, disrupt control, or jump into a hot corporation. Table talk is encouraged. Ties go to the director (first player), which turns negotiations into leverage.

In one game, I forced an auction at the exact right moment, tanked a rival’s majority, and slid into the presidency. Delicious.

Then each player takes two actions: one investor action and one alien tech action. Investor actions include building outposts (paid or free), scrapping a corporation’s ship for cash, or permanently removing a vote token to gain an alien tech cube.

Alien tech cubes are candy. You’ll always want more, and chasing them can tempt you into inefficient routes.

On the alien tech action, cubes can permanently boost cargo, unlock wormholes, launder into money, or develop planets. Developing a planet doubles its value for all current and future corporations with an outpost there—an immediate, table-wide economic ripple.

Sign Here, Here, and Here

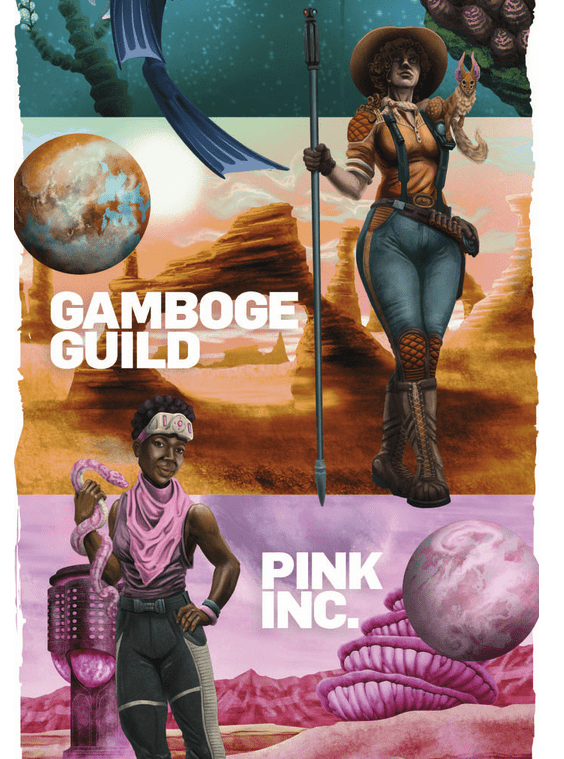

If a corporation has outposts on two or more alien planets, it can sign an agreement. More alien presence means juicier payouts: aliens buy a share, shareholders get a bonus payout, and the corporation gains a new tech tile plus increased endgame share value.

But agreements can be a benefit and a liability rolled into one. If alien mining exceeds the corporation’s mining at the end of the game, a hostile takeover reduces all shares to a value of one. The game telegraphs this pretty well, so it’s not a “gotcha”—but at lower player counts, it can feel toothless, which is a shame because it’s one of the best thematic pressures in the design.

Market Close

Administration resets the round: ships deliver (increasing cargo capacity), the lowest purchasable ship level is removed, and turn order shifts based on mining capacity.

At the end, corporations liquidate: hostile takeovers are resolved, and share values are calculated from total mining and cargo capacity divided by corporation size.

Congratulations on your workday on the galactic trading floor!

Shareholder Report

I can’t claim enough 18XX mileage to classify Stellar Ventures with authority, but it clearly borrows from cube rails: rusting (vessel depreciation), dividends, auctions, shared ownership, and presidency pressure. What’s missing are the more brutal levers—sellable shares, deep stock manipulation, and player-driven endgame triggers.

For me, that’s a plus. Stellar Ventures sits in that hybrid euro/cube-rails space alongside games like Irish Gauge and Wabash Cannonball. Put Age of Steam in front of me, and I start micro-stressing over math; here, the guardrails keep things moving. Dividends and share values are chart-simple and transparent. The round structure is even printed on the board, which makes onboarding painless.

Blocking is minimal, too. Space can host multiple corporations (at an added cost), so you’re rarely shut out entirely. Instead of racing to lock down track, corporations race toward Mega-Earth: a distant planet with massive mining jumps and only four slots. Fully populated, it can push value up to 15 for each corporation there—which is huge. The puzzle is getting there efficiently with limited outposts, usually from the opposite side of the map, making wormholes feel both necessary and delightfully thematic.

Earnings Call

One of the things I ended up liking more than I expected was that dividends are paid by the bank instead of coming out of a corporation’s treasury. It quietly removes a lot of the pressure I usually feel in heavier economic games. Money is still tight, but it’s not suffocating, and I never felt like a single bad decision would ruin a corporation for the rest of the game. It gave me more freedom to build, expand, and take risks, at least until the moment I had to issue another share to raise capital. That’s where the tension snaps back into place. I really enjoyed that push and pull between spending aggressively and protecting dividend value. Finding the right equilibrium between mining and cargo capacity to maximize dividends also adds to the fun puzzle.

It also helped shift my mindset toward treating corporations as tools rather than something I had to baby. I found myself pushing them harder than I normally would, knowing that the real consequences would show up later in share value. That made the investor phase feel especially cutthroat in a fun way, as everyone around the table was clearly weighing short-term gains against long-term payoffs. The balancing act of increasing both the mining and cargo capacity for better dividends is a fun puzzle of equilibrium.

Technology tiles ended up being one of my favorite parts of the game. Some of them are immediate boosts, others stick around for the long haul, but almost all of them open up interesting efficiencies or alternate paths. Being able to build through anomalies, snag discounts, permanently boost capacities, or mess with alien tech cubes gave each corporation a distinct feel. There’s randomness in what comes out, sure, but it never felt arbitrary. Instead, the technologies gently nudged me toward certain strategies without locking me into them.

Alien agreements added another layer of tension that I really appreciated. The aliens don’t just snowball on their own; their mining capacity only increases because of player choices. Since all of that information is out in the open, the threat of a hostile takeover felt more like a calculated gamble than a gotcha moment. I could usually see the danger coming and decide whether the rewards were worth it. That said, endgame tech can still throw a wrench into things, and watching one player completely tank another corporation at the last second was equal parts brutal and hilarious. That intergalactic “nationalization” moment stuck with me.

Player count mattered more than I expected. At three players, I noticed that corporation presidents rarely changed, which left some people feeling more like passengers than drivers. Once we hit four or five players, the game really opened up. Corporations were pushed to their limits, expansion bottlenecks started forming, and technologies that bypassed restrictions suddenly became way more valuable. Share auctions felt tense, vote tokens felt precious, and a single forced sale could completely swing the game.

The hostile takeover system also felt much more relevant at higher player counts. With more corporations signing agreements, alien mining capacity ramped up faster, and that looming threat actually mattered. When that system fires on all cylinders, it gives Stellar Ventures some of its sharpest edges.

Overall, I found downtime to be pretty minimal. Even when it wasn’t my turn, I stayed engaged because other players’ decisions almost always had ripple effects. The only time things dragged was when someone tried to math out every possible outcome, but thankfully, the game’s transparency helped keep that in check.

A Stellar Time

I’ve really been enjoying the recent wave of hybrid euro/train games, and Stellar Ventures has quickly become one of the more memorable ones for me. It delivers a full space-themed economic experience in a clean 1.5 to 2 hours, which is a sweet spot for my group. By the end of every play, the table was buzzing with shoulda-woulda-couldas, playful accusations of corporate collusion, and debates over whether issuing that last share was genius or a huge mistake.

What kept pulling me back was how replayable the game felt without relying on gimmicks. Different corporations start in different spots, and those starting positions actually matter. Pair that with a wide range of technology tiles and shifting alien incentives, and each game naturally steered itself in a different direction. One play might focus on aggressive expansion and dividend farming, while another becomes a tense race to Mega-Earth or a risky gamble on alien partnerships.

The real strength of Stellar Ventures is how clean the design feels. It takes a lot of familiar economic ideas and trims away the parts that are usually intimidating. The euro structure keeps things grounded and readable, while the cube rails elements inject high interaction, negotiation, and just enough player interference to keep everyone honest. I never felt overwhelmed, nor did I ever feel bored.

So is this an 18XX game or a cube rails game? From where I’m sitting, it’s kind of both and neither. It borrows ideas from across the train game spectrum and blends them into something that feels approachable without losing depth. That middle ground is exactly where I’m most comfortable, and Stellar Ventures hits it squarely.

If train or economic games have bounced off you in the past, this feels like a great entry point. I never felt lost; the systems are easy to read, and the theme does a lot of work making abstract mechanics click. At the same time, there’s enough going on here to keep more experienced players engaged, especially when it comes to timing share issuance and leveraging technology.

While the prototype only had a single map, it already left me wanting more. The framework feels flexible enough to support wildly different layouts and incentives, and I’m genuinely excited to see what future maps might do to the puzzle.

Stellar Ventures is coming to Kickstarter in January 2026.