Disclosure: Meeple Mountain received a free copy of this product in exchange for an honest, unbiased review. This review is not intended to be an endorsement.

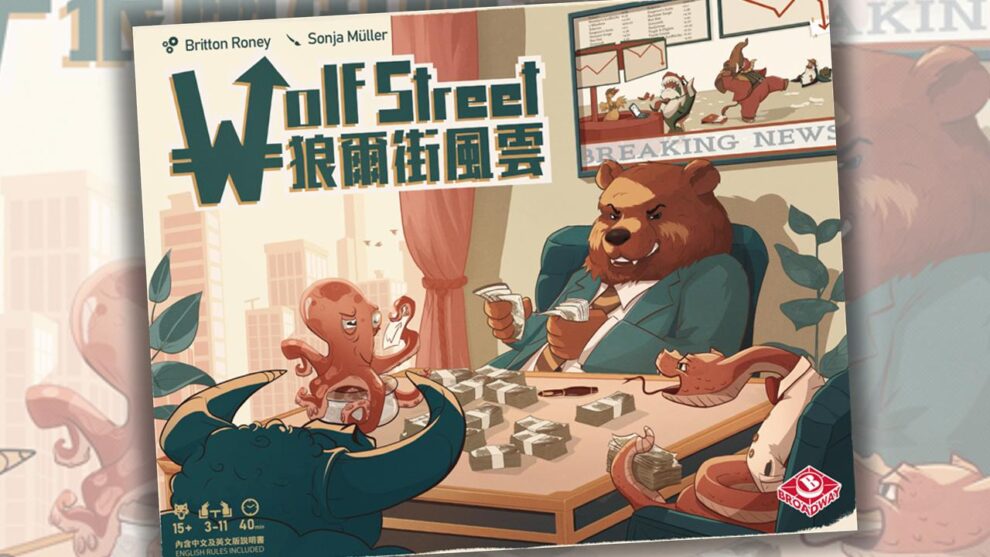

Another review, another reprint. I’m not sure why I keep putting myself through this, but there’s a solid reason this time. Wolf Street is a remake of an older game called Panic on Wall Street! It didn’t make much of a splash when it was first released, and it’s been out of print for years. I played Panic on Wall Street! many years ago and vaguely remember enjoying it. It stood out as one of the few games where there’s more than one winner.

This is a negotiation game between two sides: the Managers and the Investors. The Managers aim to collect stocks and negotiate management fees with the Investors, all while creating unique sets for bonus points. Meanwhile, the Investors focus on maximizing their return on investment. Each stock has the potential for income (or loss), and they want to minimize management fees.

That’s the basic rundown. The game itself is hardly more complicated than its premise. Throughout five rounds, everyone at the table will go through a series of phases, keeping things straightforward.

Negotiation With a Clock

The first part of the round is a tense two-minute negotiation. No turns here. Everything happens in real time. Investors will chat with the Managers to discuss fees and stocks, while Managers are trying to get as much pocket change as possible from the Investors.

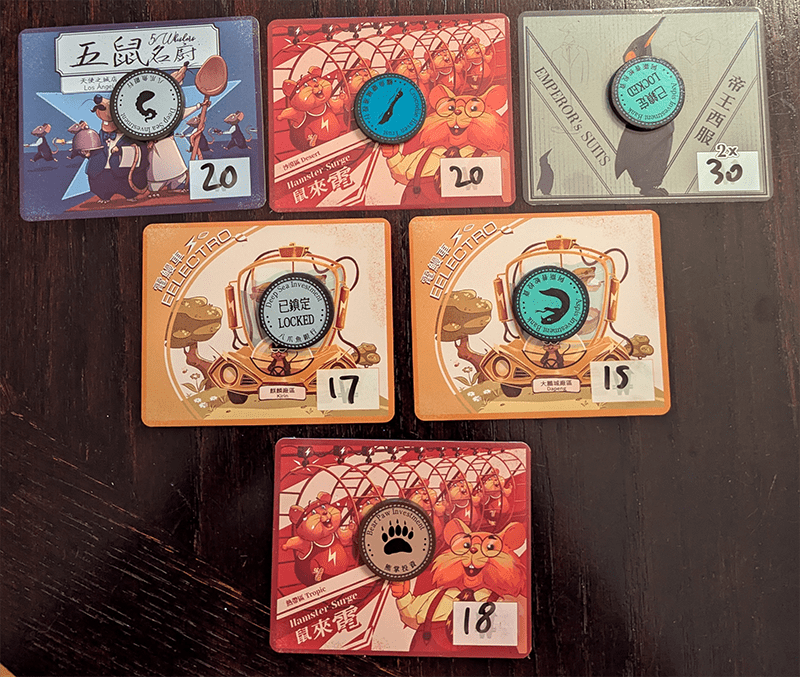

What makes the negotiation phase interesting is its flexibility. Even after agreeing on a price and stock, both the Investor and Manager can still seek better opportunities elsewhere. The Investor can back out if they find a more appealing deal, or the Manager may discover another Investor willing to pay more. There’s also the option to lock in the deal. If both sides agree, the deal is finalized, and neither the Investor nor the Manager can make any further adjustments.

Once the negotiation wraps up, it’s time to see if any income is generated. This is where the risk levels of the four stocks come into play. Four dice are rolled, each representing the movement of a stock on the income track. After the roll, the pieces move to their new positions, and everyone either collects income or must pay based on their stock holdings.

What’s intriguing about this system is the varying risk levels of the four stocks. Not only are the income payouts different for each stock, but the dice rolls also move them differently. For instance, the low-risk blue stock only moves 1 or 2 spaces, while the high-risk red stock can move 3 or even 7 spaces! These markers stay in place for the next round, which can make future negotiations for the same stock a bit more complex.

Once the income is determined, money is paid out, followed by the payment of management fees. After receiving their cut, the Managers must pay $10 for each stock they hold, effectively setting the $10 as the floor price.

Money Talks, Paper Doesn’t

The final phase of the round is the auctions. New stocks are introduced, and the Managers engage in a blind auction for them. This not only helps them build their catalog for future rounds but also allows them to collect unique sets for endgame scoring bonuses. After this happens five more times, the game ends. The richest Investor and Manager are crowned the winners.

While there is a lot to like about Wolf Street, it isn’t the pot of gold at the end of the rainbow here. For one, the game is absolutely unforgiving. There’s no real comeback mechanic, so if you make a bad deal or suffer a poor income due to some unlucky dice rolls, it’s entirely possible you’ll be out of the game even before the midway point.

Then there’s the issue of the negotiation phase. While some players will thrive in this fast-paced, free-for-all environment, it’s not for everyone. If you’re not paying attention during those two minutes, or if you’re someone who struggles with negotiations, you might find yourself isolated. This game really caters to a specific crowd: people who love to talk and haggle. If you’re an introvert or prefer a quieter experience, Wolf Street will not work with you.

For Better or Worse

Another point of frustration is the dice. While I personally don’t mind the random element since it does capture the concept of stock speculation, some players will likely find it annoying. You can craft the perfect deal, but the dice might still ruin your plans, which can feel unfair.

And finally, the paper money. It’s pretty subpar. We were constantly running out of bills and scrambling to make change. This is one of the few times I would recommend alternatives, and dare I say, even use Monopoly money for this. It’s a small thing, but it adds to the overall frustration.

Yet I cannot ignore the fact that I greatly enjoy this game. It is one of the better negotiation games out there in tabletop.

My biggest gripe with most negotiation games is that they often force you to put everything on the line, such as your victory points, hoping what you get in return is worth the risk. The issue with this approach is that it turns negotiations into a cold, calculating affair, where players are hesitant to commit. As a result, experienced players often come out on top, not through clever cooperation, but by steamrolling less experienced players.

When It Works, It Works

This is where Wolf Street really shines. The Investor and Manager roles aren’t at odds with each other; they’re cooperating for their own agendas. Both sides have clear, distinct goals. The Investors are focused on grabbing stocks that align with their risk tolerance while minimizing fees.

Meanwhile, the Managers are looking to charge as much as possible while ensuring their stock inventory matches what the Investors are after. Managers couldn’t care less about a stock’s performance. Because of this transparent relationship, every successful handshake feels like a calculated move toward outpacing your rivals within your own faction.

What’s even more impressive is that, despite the abstraction and randomization of the stock’s performance, Wolf Street does a solid job of simulating the unpredictability of the market and the after effects. While the game doesn’t dive into the finer details, like government regulations, rumors, trends, or corporate leadership changes, the dice roll effectively emulates the chaos of high-risk stock performance.

The ever-changing performance of these stocks also has the added benefit of making the relationship between Managers and Investors dynamic. When high-risk stocks are profitable, everyone is rushing to pay top dollar to grab a piece, much like the market frenzy around today’s hot trends like crypto or AI.

On the flip side, when high-risk investments are losing money, players naturally gravitate toward safer options, such as fixed-income assets like bonds for stability.

Closing Bell

This creates an interesting environment, as managers focused on high-risk stocks have to scramble to attract investors, even when the odds seem stacked against them. In a sense, it reflects the real-life balancing act that financial advisors face when trying to meet the demands of their elusive investor clients.

Ultimately, Wolf Street may not be flawless, but it stands out as one of the more thrilling party negotiation games around. It’s quick, unpredictable, and rewards smart moves, even if a bit of luck is involved. Just be ready for a wild ride, and maybe a few frustrating moments along the way.