Disclosure: Meeple Mountain received a free copy of this product in exchange for an honest, unbiased review. This review is not intended to be an endorsement.

In the realm of board gaming content, whether it be TikTok videos, YouTube videos, or written pieces like this, one would naturally expect the creators to possess a certain level of expertise. Videos often leverage the “board game shelf backdrop” as a visual cue to establish the person as an expert, while writers rely on personal anecdotes or stories to convey their knowledge to the consumer. Though somewhat of a cliché now, it remains an effective technique, which is why people like myself love to abuse it.

I’ve been into board games for nearly 20 years, starting out in the early 2000s. One of the games that got my feet wet on the sandy beaches of board gaming was Acquire. It is a game about investments where you throw money into hotel chains in exchange for stocks, hoping for big payouts.

The grid board represents the market, and each turn, a player places a tile to create a new hotel chain or expand an existing one to increase the stock price. Acquire’s hook is the name itself. When a larger company merges with a smaller one, the shareholders of the smaller company get a payout, and this is the only way to sell your stocks.

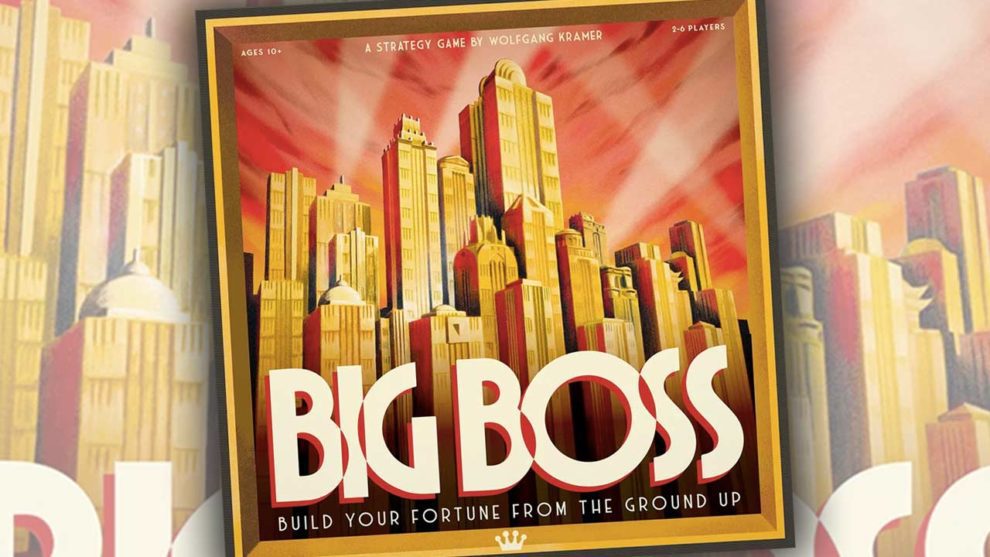

The reason for this brief history lesson is that Big Boss is a variant of Acquire, similar to Captain’s Gambit being a variant of Coup. According to legend, designer Wolfgang Kramer sought to create his own spin-off of Acquire, and Acquire’s designer Sid Sackson gave him the thumbs up. It was only released in Germany in the mid-1990s with minuscule fanfare.

Rebranding

Several decades later, Funko Games gets this bad boy published in English, and I had never heard of this game before. For me, this feels akin to being aware that George Lucas is a film director but remaining oblivious to Star Wars or Indiana Jones. At this point, you could direct me towards a nearby wall, hand me a cigarette, and provide a blindfold. I clearly do not deserve the designation of “board game expert” anymore.

In all seriousness, Big Boss follows in the same footsteps as any other 1990s board game involving money. You start with forty million, which for some reason isn’t enough, and you want the biggest bag out of your circle of opponents at the end of it all. This will not only involve buying stocks but also founding and merging companies.

To help you on this quest for riches, you start with a hand of industry cards with a number on them. The number corresponds with the numbered spaces on the game board. Think of them as title deeds, giving you access to that space to create companies or grow existing ones.

On your turn, you pick one of two actions. Buying a card is as simple as it sounds. There will be six face-up industry cards for you to pick for a mere five million each, or you can always pick a level-up card for ten million. Hand limits do not exist in this universe, and you get your money back at the end of the game, so unused cards don’t hurt you.

The playing card action is the lifeblood that animates this game. By playing an industry card that isn’t connected to any company, a new company is formed. This newly created company occupies three spaces on the board with building pieces, and a fourth piece is stacked on one of the initial three. For being such a generous venture capitalist, you are rewarded with five million dollars and can immediately use it to purchase up to two shares of existing companies.

Furthermore, you can play cards to expand existing companies if the played space connects to one of them. Additionally, under specific circumstances, it is possible to stack building pieces on top of each other with an industry card or level-up card. This aspect holds significance as the level of the newly stacked piece directly impacts the stock price, increasing it accordingly. For instance, stacking a piece on the third level results in a three-point increase in the stock price. Following the execution of this action, an immediate cash payout is granted based on the revised stock price. Subsequently, you have the chance to acquire up to two shares of existing companies.

Thriving Through Acquisitions

Since this is a spin-off of Acquire, companies will be bought out during these chains of establishing companies and growth. The process is effortless. Essentially, the company with the higher stock price absorbs the company with the lower stock price. The holders of the smaller company receive an instant cash payout based on the current stock prices, while the larger company assimilates the stock price of the smaller company.

The player responsible for initiating the merger gains a cash payout based on the updated stock price as well. Regarding the smaller company, it is eliminated from the game, merely continuing its existence as a mere footnote in the intense battle of corporate acquisitions.

There are a few more rules, such as the radio towers players can buy to secure themselves three extra shares; otherwise, that’s the extent of Big Boss. Buy a card to add to your hand or play a card to get a building block on the board to earn some cash, followed by a few stock purchases. Once all one hundred building blocks run out, everyone cashes out their portfolio, with the one with the most money being the winner.

Now the big concern that will likely be on a few people’s minds is whether they should get this game or Acquire. Both want to tell a story about a bastardized version of insider trading with the same end goal of having the most cash. Is one better than the other? The answer is neither, as both serve completely different purposes despite wearing similar clothes.

Acquire is more interested in telling the story of the ascent, decline, and revival of companies propelled by the hands of the power players at the table. Since the game greatly rewards players who have the majority of shares in acquired companies via majority shareholder bonuses, its entire focus revolves around maneuvering to secure that position while gradually expanding the companies, tile by tile.

It is designed for long-term strategic engagement, and when an acquisition eventually transpires, it generates an intensity akin to the drum solo in Phil Collins’ “In the Air Tonight.” Intentionally paced and deliberate, Acquire gradually gains momentum until it reaches its full potential, reminiscent of a powerful Zweihander blade in action.

Meanwhile, the Big Boss experience is death by a thousand cuts. Turns and money flow faster than a flushing toilet in the southern hemisphere. There are no bonuses for majority shareholders, rendering company loyalty more mythical than reality. You are constantly planning for the moment as you strive to have a finger in every pie, and you’re angry that you only have two hands. Collaborations and unrequested alliances maneuver across the board as players conspire to construct and merge companies for their own selfish gains.

Acquire seeks to welcome the strategic chin-strokers, while Big Boss wants you to evoke and dismantle emotions through swift card plays.

Rewire Their Emotions

Initial impressions of Big Boss are unlikely to steer you in this direction. Targeting the family market, like many other Funko Games, Big Boss caters to those who may not be well-versed in board games. However, as you observe the game’s gears clicking into place, you begin to witness the extent of your manipulative abilities and how easily you can be manipulated in return.

One major change Big Boss has made compared to Acquire is the board layout. Acquire uses a grid, while Big Boss has a linear path that coils around the board. Outside of stacking upwards, companies in Big Boss can only expand in two directions. All numbered industry cards are unique, meaning there is only one copy of each numbered card. So if someone snatches a card from the market that you need to merge with another company, it’s over, right? Yes and no. This is where Big Boss betrays its friendly intentions and spotlights its true colors.

Let me give you an easy example. You founded and have invested in the yellow company Oasis. You see an easy opportunity to acquire the red Fortress company, yet the player next to you took the 18 industry card that you needed. He has some stocks in the Fortress company as well.

In response to this cardboard crime, you spend the next few turns buying level-up cards. After two or three turns of buying these cards, you start to play them to improve the price of Oasis and get your money back. With this newfound wealth, you start buying stocks in other companies, including Fortress. After all, if a merger is going to happen, you want to get both sides of the deal since you get a payout for the Fortress stocks while improving the value of your Oasis stocks.

Something happened during these upgrades, though. Other players are now also buying Oasis stock to ride on your upgrades. Congratulations! You brought FOMO to the table since stocks are limited and people will gain a nice bit of change for upgrading Oasis, thereby helping you. Not only that, but now the player holding the 18 card is absolutely considering playing it since he can get a big payout for initiating the merge. Opportunity costs smoke bombs everyone’s decisions here.

That serves as just one example, and I can continue with these tactics. It demonstrates the ingenious nature of Big Boss, equipping you with the means to skillfully manipulate the emotions of your opponents.

Always Be Closing

Now I will state that impressions are based on the revised rules prominently featured in the rulebook. You can play with the original 1990s rules, and the rulebook does provide a one-page summary of all of the changes. Although I could elaborate on my impressions after three sessions in several additional paragraphs, I would rather summarize my experience with just two words: Never again.

The only legitimate critique I have pertains to the packaging. In simple terms, it is excessively tight. While I understand the desire to maintain consistent box sizes for branding reasons, the tightness is to such an extent that the building pieces have left indents on the game board. It’s weird to see this since Pan Am made excellent use of its box space. It’s not the biggest problem in the universe, and it’s hardly noticeable in play, but it’s an oversight worth mentioning.

Apart from that, Big Boss serves as an outstanding gateway game for those who enjoy financial investments in their board games. Sure, it’s not exactly an accurate representation of the stock market, but no board game is. Acquire remains available for those seeking a more profound game with a relentless and unforgiving system, and I must confess a personal preference for it over Big Boss. However, this doesn’t imply that Big Boss is inferior. It’s similar to debating the color of your favorite sports car: Regardless of your choice, you’ll still end up with something satisfying, and it ultimately boils down to personal preference.

I have both. I got my first copy of Acquire in 1966. And we just got the new Big Boss recently. Love them both. The revised rules to BB are good. BTW, BB was re-skinned as Chartered:The Golden Age in 2019. We own that as well. Nice comparison.